Asaan Mobile Account (AMA): How Pakistan’s USSD Banking System Is Quietly Transforming Financial Inclusion

From VRG interoperability to Raast integration, security safeguards, and women’s financial empowerment — a complete deep-dive into AMA.

🌍 Introduction: Banking Without Apps, Internet, or Smartphones

In a country where millions of people still rely on basic mobile phones and limited internet access, Asaan Mobile Account (AMA) has emerged as one of Pakistan’s most quietly revolutionary financial systems.

Unlike mobile wallets that require a specific SIM or smartphone app, *AMA allows any Pakistani citizen to open a bank account using a simple USSD code (2262#) — no internet, no app, and no branch visit required.

But behind this simplicity lies a powerful technical infrastructure, strict security mechanisms, and a broader national strategy for financial inclusion, especially for women and underserved communities.

This article explores how AMA really works, its technical backbone, security layers, social impact, and future direction.

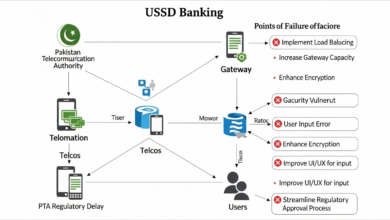

🧠 1. The Hidden Technical Backbone: VRG & Interoperability

At first glance, AMA looks like a basic USSD service. In reality, it is not owned or operated by a single bank or telecom company.

🔧 Virtual Remittance Gateway (VRG)

The system is powered by VRG (Virtual Remittance Gateway) — a licensed entity approved by:

- State Bank of Pakistan (SBP)

- Pakistan Telecommunication Authority (PTA)

VRG acts as a central interoperability switch, connecting:

- All participating banks

- All major mobile operators (Jazz, Telenor, Zong, Ufone)

This means AMA is network-agnostic and bank-neutral.

🌐 Why Interoperability Matters

Thanks to VRG:

- A Jazz SIM user can open an account in Meezan Bank or UBL

- No bank is limited to a specific telecom network

- Consumers are free to choose banks, not forced into telecom-owned wallets

This breaks the traditional monopoly model seen in many mobile wallet ecosystems.

🔐 2. Security & Privacy: Is USSD Really Safe?

One of the most common questions about AMA is security — especially because it operates on USSD, a technology older than smartphone apps.

Despite this, AMA follows bank-grade security protocols.

🛡️ Key Security Features

🔹 SIM Binding

- The account is linked only to the SIM registered on your CNIC

- Even if someone steals your phone, the account cannot be accessed using another SIM

🔹 NADRA Real-Time Verification

- Every account opening request is verified instantly with NADRA

- This prevents fake or duplicate accounts

- Supports Anti-Money Laundering (AML) compliance

🔹 Session Timeout Protection

- If the user does not respond during a USSD session

- The system automatically terminates the session

- Prevents misuse if a phone is left unattended

In short, AMA is simple for users, strict behind the scenes.

⚖️ 3. Banking on Equality: A Game Changer for Women

Under the State Bank of Pakistan’s “Banking on Equality” policy, AMA plays a critical role in reducing the gender gap in financial access.

👩💼 Why AMA Matters for Women

In many parts of Pakistan:

- Women face mobility restrictions

- Bank branches are far away

- Account opening often requires male assistance

AMA removes these barriers completely:

- Account opened from home

- No physical visit

- No smartphone required

- No dependence on a male relative

As a result, millions of women now have:

- Personal bank accounts

- Control over income

- Direct access to government support

This is not just banking — it is economic empowerment.

💳 4. Expanding Services: Beyond Basic Banking

AMA started with basic services like balance inquiry and transfers. Today, it is evolving into a full financial access platform.

🏛️ Government-to-Person (G2P) Payments

The Government of Pakistan is working to route payments such as:

- Benazir Income Support Programme (BISP)

- Other social welfare funds

Directly into AMA-linked accounts, reducing:

- Cash handling

- Fraud

- Middlemen

🛡️ Micro Insurance Services

Some partner banks now offer:

- Low-cost life insurance

- Basic health coverage

Directly tied to AMA accounts — a major step for low-income households that traditionally lack insurance.

⚡ Raast Integration: The Future of Instant Payments

AMA accounts are now being linked with Raast, Pakistan’s instant payment system.

Benefits include:

- Near-instant transfers

- Extremely low or zero transaction fees

- Seamless person-to-person payments

This positions AMA as a long-term national digital banking layer, not a temporary solution.

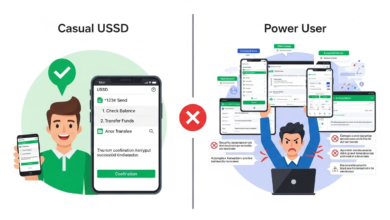

🚧 5. Challenges & Awareness Gaps

Despite its success, AMA still faces real-world challenges.

📡 Network Issues

- In remote areas, weak signals cause USSD sessions to drop

- This affects transaction reliability

📖 Digital Literacy

- Many users struggle with menu-based navigation

- Ongoing efforts include simpler Urdu menus

These are implementation challenges, not design flaws — and they are actively being addressed.

📊 AMA vs Traditional Mobile Wallets

| Feature | Asaan Mobile Account (AMA) | Traditional Mobile Wallet |

|---|---|---|

| Network Dependency | Any SIM, any bank | Specific SIM or app |

| Access Code | *2262# | Company-specific codes |

| Internet Required | ❌ No | ✅ Yes (for apps) |

| Bank Choice | 13+ banks | Single provider |

| Interoperability | Fully interoperable | Closed ecosystem |

AMA clearly prioritizes freedom, inclusion, and neutrality.

🔮 Conclusion: A Silent Financial Revolution

Asaan Mobile Account is not flashy.

It does not rely on apps, advertisements, or smartphones.

Yet, it may be Pakistan’s most inclusive financial innovation to date.

By combining:

- Interoperability (VRG)

- Strong security

- Gender inclusion

- Government integration

- Raast-powered instant payments

AMA is quietly laying the foundation for a truly universal banking system — one that works for everyone, not just the digitally privileged.