What Regulators & Operators Must Fix in USSD-Based Banking

Actionable recommendations for improving USSD reliability and financial inclusion in Pakistan

Introduction: USSD Banking Still Faces Critical Failures

USSD remains the backbone of mobile banking for feature phone users in Pakistan. Despite its reach and potential, users face repeated failures such as:

- Session expiry during transactions

- Rejected long inputs

- Timer reset failures

These failures are not accidental. They are the result of infrastructure and operational gaps.

To ensure USSD fulfills its promise of financial inclusion, regulators and operators must act now.

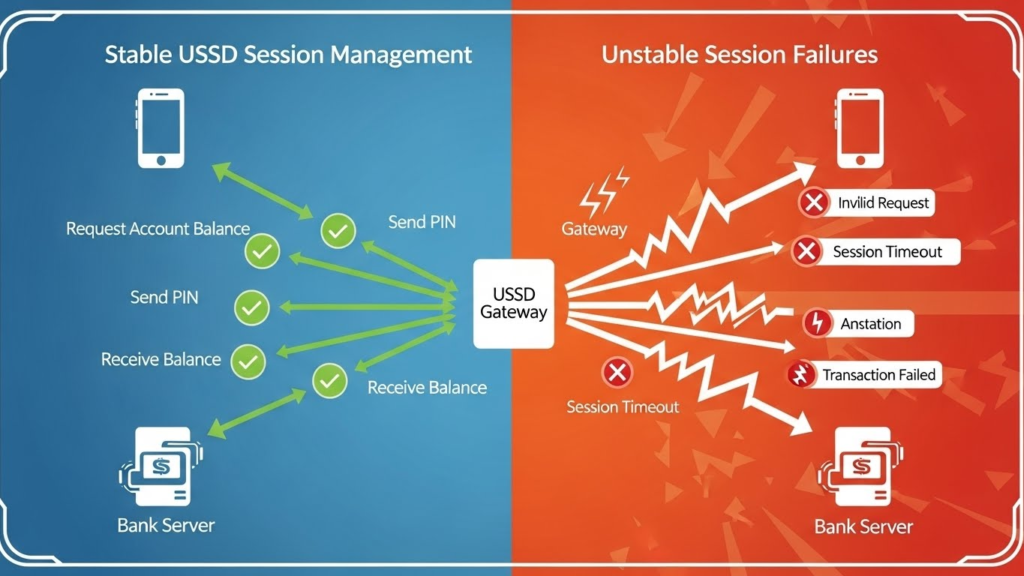

The Problem: Infrastructure Undermines Financial Services

Successful mobile banking relies on stable, predictable, and secure USSD sessions. However, current gaps in network infrastructure and session management create serious barriers for users. Some of the most critical issues include:

- Very short inactivity timeouts that terminate a session before users can complete multi-step transactions

- Inconsistent session timer refresh, meaning even active users can be unexpectedly logged out

- Poor handling of multi-step or long input, such as account numbers, IBANs, or verification codes

- Lack of error recovery mechanisms, so users often must restart from the beginning after a session failure

These issues disproportionately affect vulnerable populations, including rural residents, low-income users, and anyone without a smartphone or stable internet access.

A clear example of this challenge is Pakistan’s Asaan Account, a universal banking service that allows users to manage their accounts and perform transactions entirely via USSD, without the need for internet or mobile apps. Asaan Account can be accessed from any mobile network and linked to any bank, making it a critical tool for financial inclusion. Yet, because USSD sessions can expire unpredictably or reject long inputs, many users cannot complete even basic operations such as balance checks, fund transfers, or bill payments.

This demonstrates that the success of digital financial services depends as much on infrastructure as on product design. Even a well-conceived service like Asaan Account fails if the underlying USSD platform is unstable, short-timed, or poorly managed. To make USSD a reliable channel for financial inclusion, operators and regulators must address these structural limitations.

Action 1: Regulators Must Enforce Session Standards

The Pakistan Telecommunication Authority (PTA) can help by:

- Mandating minimum session durations suitable for financial transactions

- Requiring session timer refresh after every valid user input

- Ensuring telcos implement proper error recovery and retry mechanisms

This ensures predictable and trustworthy USSD service for banking.

Action 2: Telcos Must Upgrade USSD Infrastructure

Operators should:

- Modernize USSD gateways to support multi-step, long-input sessions

- Prioritize financial-grade stability for USSD traffic

- Implement logging and analytics to monitor session failures

- Align infrastructure with GSMA best practices for mobile financial services

These steps reduce transaction failures and build trust.

Action 3: Align With International GSMA Guidelines

While not a citation-heavy discussion, telcos can follow GSMA principles for USSD banking:

- Reliable session management

- Security during multi-step flows

- Support for long input and confirmation steps

- Fail-safe mechanisms for session expiry

Applying these principles improves usability and inclusivity without reinventing the system.

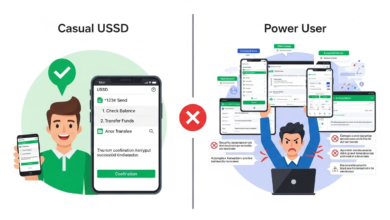

Action 4: Focus on the End User

All improvements must keep the user experience in focus:

- Minimal risk of losing transaction mid-way

- Clear instructions for step-by-step navigation

- Recovery options if the session times out

- Consistency across all devices, including low-end feature phones

When infrastructure meets user needs, financial inclusion goals can be achieved effectively.

Why Immediate Action Matters

USSD failures are not just technical glitches — they directly erode trust in mobile financial services.

Without regulatory pressure and operator commitment:

- Users revert to cash-based transactions

- Mobile banking adoption stagnates

- Financial inclusion targets are compromised

Improving USSD infrastructure is not optional; it is a prerequisite for modern digital finance in Pakistan.

Conclusion: Infrastructure + Oversight = Financial Inclusion

The path forward is clear:

- Regulators set minimum technical and operational standards

- Operators implement infrastructure upgrades

- All stakeholders follow modern principles (like GSMA guidelines)

- Users finally experience stable, reliable USSD banking

By taking USSD seriously, Pakistan can unlock financial inclusion, empower users, and build confidence in mobile financial services across all segments of society.