Why USSD Is Still Relevant — But Only If Designed Right

A realistic look at USSD, mobile apps, and the future of financial inclusion

Introduction: Declaring USSD “Dead” Is a Mistake

In recent years, USSD has often been described as outdated or obsolete. With the growth of smartphones and mobile apps, many assume that USSD no longer matters.

This assumption is technically convenient but socially inaccurate.

USSD remains one of the few technologies that:

- Works on any phone

- Requires no internet

- Reaches the most economically vulnerable users

The real question is not whether USSD is relevant, but whether it is designed and managed correctly.

The Reality: Feature Phones Are Still Everywhere

Despite smartphone growth, a large portion of users in Pakistan still rely on:

- Feature phones

- Shared devices

- Limited or no mobile data

For these users:

- Apps are not an option

- Internet is unreliable or expensive

- USSD is the only gateway to digital services

Ignoring this reality risks excluding millions from the digital economy.

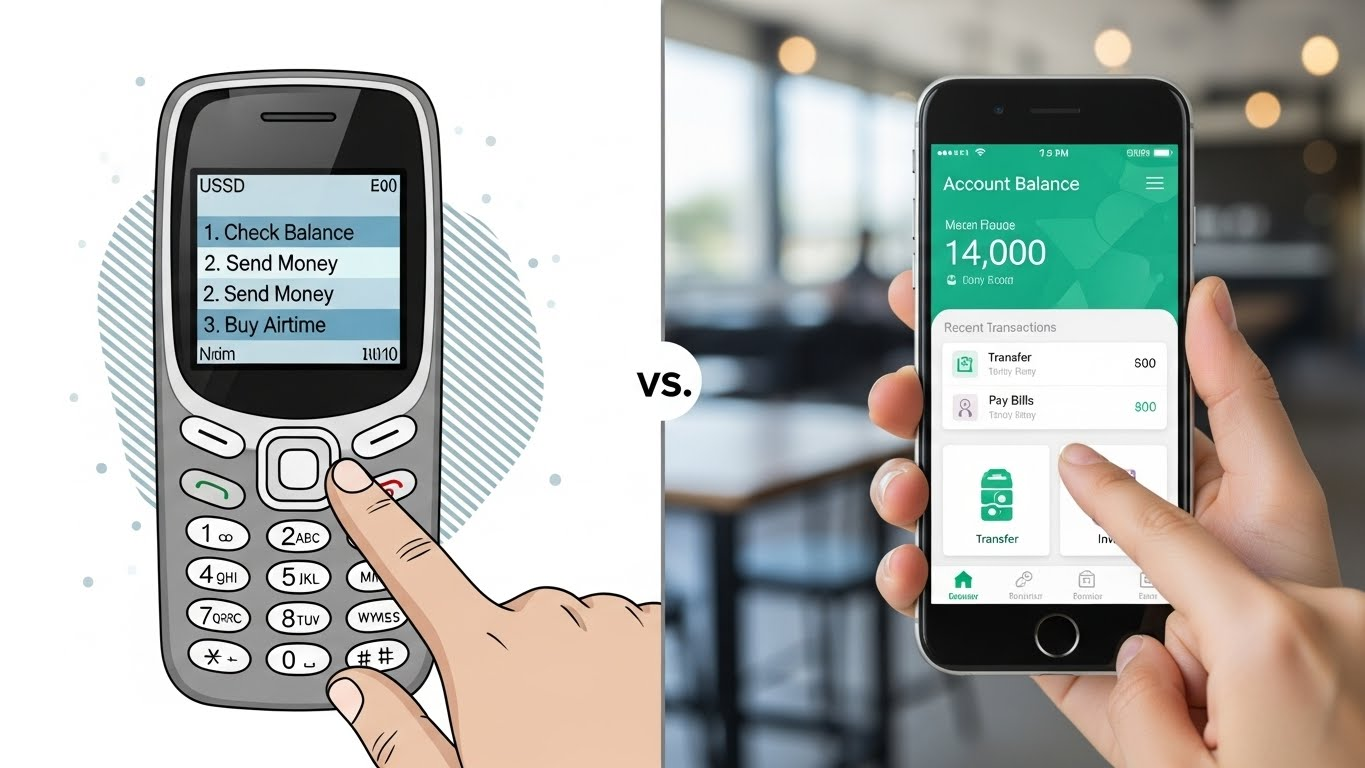

USSD vs Mobile Apps: A Fair Comparison

USSD and mobile apps serve different audiences and use cases.

Mobile Apps

- Rich user interface

- Long-lived sessions

- Background processing

- Better error handling

USSD

- Works without internet

- Instant access

- Device-independent

- Lightweight and fast

The mistake is treating USSD as a cheap replacement for apps rather than a specialized platform.

Why Apps Cannot Fully Replace USSD

Apps assume:

- Smartphone ownership

- Digital literacy

- Stable internet

USSD assumes none of these.

For:

- Rural users

- Low-income users

- First-time digital users

USSD is often the first and only entry point into financial services.

Financial Inclusion Depends on USSD Quality

Financial inclusion is not just about availability. It is about usability and trust.

Poorly designed USSD systems:

- Break sessions

- Reject valid input

- Create fear during transactions

This does not promote inclusion. It creates exclusion through frustration.

The Real Problem: USSD Was Never Upgraded for Modern Use

USSD itself is not the problem.

The problem is that many networks still use:

- 1990s session assumptions

- Extremely short timeouts

- No tolerance for user thinking time

Modern financial services require:

- Longer sessions

- Stable state management

- Input-friendly flows

Without these, USSD cannot support serious services.

What “Designed Right” Actually Means

Designing USSD correctly means:

- Realistic inactivity timeouts

- Proper session timer resets

- Support for long inputs

- Clear recovery from errors

- Separation between simple and financial services

These are engineering decisions, not marketing ones.

Why Policymakers Should Care

For regulators and policymakers:

- USSD is a national infrastructure tool

- It directly affects financial inclusion goals

- Failures disproportionately affect vulnerable users

Policy frameworks that encourage or mandate:

- Minimum USSD quality standards

- Financial-grade session profiles

can dramatically improve outcomes.

Why Fintechs Should Care

For fintech companies:

- USSD expands reach beyond smartphones

- It lowers onboarding barriers

- It supports hybrid models (USSD + app)

But only if:

- The telecom infrastructure is reliable

- Session behavior is predictable

Fintechs should demand platform guarantees, not assumptions.

The Future: USSD as a Complement, Not a Competitor

USSD should not compete with apps. It should complement them.

A realistic future model:

- USSD for access and onboarding

- Apps for advanced features

- SMS or IVR as fallback

This layered approach respects user diversity.

Conclusion: USSD Still Matters, But Only with Serious Engineering

USSD is not obsolete. It is underserved.

When designed correctly, USSD can:

- Enable financial inclusion for millions of users without smartphones or reliable internet

- Support broader digital access across rural and underserved areas

- Reach users no app or online platform can reach effectively

- Provide an instant, lightweight, and secure channel for essential services

When ignored or treated casually, USSD becomes a barrier instead of a bridge, creating frustration, failed transactions, and lost trust among users who depend on it most.

The future of inclusive digital services does not lie in abandoning USSD but in investing in modern engineering, reliable session management, and user-friendly flows. Only then can USSD truly fulfill its potential as a critical tool for financial inclusion, digital empowerment, and equitable access to services across Pakistan.