Case Study: How Infrastructure Failure Led to the Collapse of ZONG TimePey & PayMax

Why the product vision was sound, but the underlying USSD system was not ready

Introduction: When a Good Idea Meets the Wrong Infrastructure

ZONG’s TimePey and later PayMax were introduced as USSD-based payment and wallet solutions aimed at increasing financial inclusion in Pakistan. The idea was simple and powerful:

- No smartphone required

- No internet needed

- Works on any mobile phone

On paper, this made TimePey & PayMax ideal for the Pakistani market. However, despite the promise, both services eventually failed to gain sustainable adoption and were discontinued.

This case study does not ask why the product failed. Instead, it asks a more important question:

Why did the infrastructure fail the product?

The Role of USSD in TimePey & PayMax

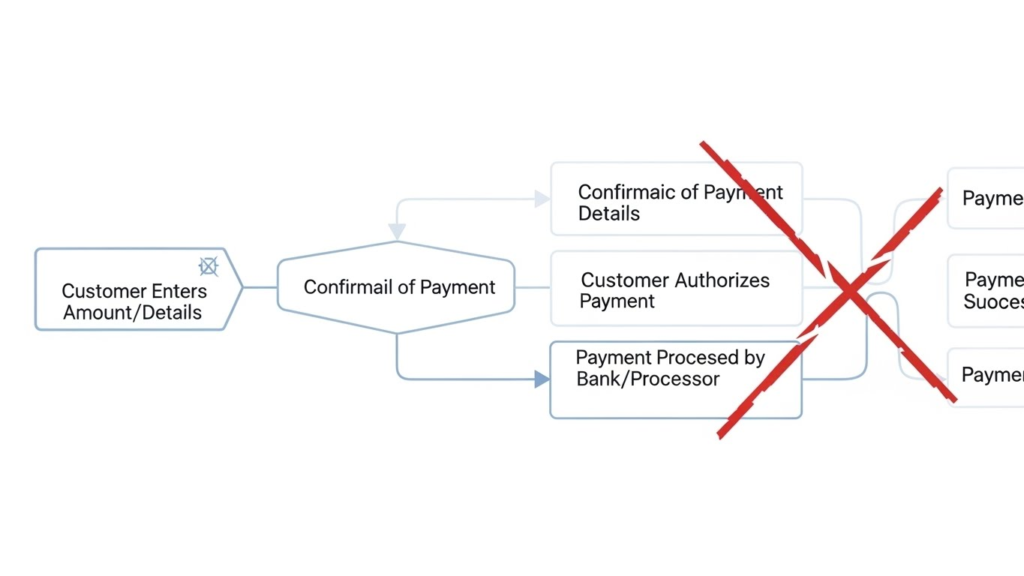

Both TimePey & PayMax depended heavily on USSD for:

- User registration

- Balance inquiries

- Payments and transfers

- Confirmations and security steps

This meant the success of the entire service relied on stable, long-lived, and predictable USSD sessions.

Infrastructure Expectation vs Reality

What the Product Required

TimePey & PayMax required USSD to support:

- Multi-step flows

- Secure confirmations

- OTP-like verification

- Long user input

- Thinking time for financial decisions

What the Infrastructure Delivered

The actual USSD behavior showed:

- Aggressive session expiry

- Weak timer refresh logic

- Poor handling of long inputs

- Inconsistent session stability

This mismatch created constant friction for users.

Failure Point 1: Session Expiry During Critical Steps

One of the most damaging issues was session expiry at critical moments, such as:

- While entering account numbers

- Before payment confirmation

- During identity verification

From a user’s perspective:

- The transaction felt unsafe

- The system felt unreliable

From a system perspective:

- The USSD session simply expired

This is unacceptable for financial services.

Failure Point 2: Timer Reset Failure Between Steps

In well-designed USSD systems, every valid user input refreshes the session timer.

In the case of TimePey & PayMax:

- User input was often accepted

- Backend processing started

- The session timer was not consistently refreshed

As a result, sessions expired even when users followed instructions exactly.

Failure Point 3: Long Input Rejection in Financial Flows

Financial services require users to enter:

- CNIC numbers

- Account numbers

- Reference IDs

ZONG’s USSD platform showed clear limitations in handling such inputs reliably.

This made:

- Registration difficult

- Payments stressful

- Error recovery almost impossible

Why This Was an Infrastructure Problem, Not a Product Problem

It is important to separate product design from platform capability.

TimePey & PayMax had:

- A clear value proposition

- A relevant market

- Strong distribution through a mobile operator

What they lacked was:

- A USSD platform configured for financial-grade reliability

No amount of menu redesign can fix a session that expires unpredictably.

The Trust Breakdown

In financial services, trust is everything.

Repeated USSD failures led to:

- Incomplete transactions

- Fear of lost money

- User hesitation

- Reduced repeat usage

Once trust is lost, even a well-designed product struggles to survive.

Why Other Simple USSD Services Survived

Interestingly, ZONG’s basic USSD services continued to work well.

This created a misleading internal signal:

- “USSD is working fine”

In reality:

- USSD was only working for simple, fast tasks

- It was failing for complex, high-risk financial workflows

The Silent Cost of Legacy Systems

Legacy USSD systems:

- Are optimized for speed, not depth

- Favor short interactions

- Penalize careful users

Using such systems for financial services introduces risk by design.

Lessons for Future USSD-Based Products

This case study offers important lessons:

- USSD must be treated as a platform, not a feature

- Financial services require extended session profiles

- Long input and thinking time must be supported

- Infrastructure limits define product success

Ignoring these realities leads to predictable failure.

Conclusion: When Infrastructure Decides the Outcome

The collapse of ZONG TimePey & PayMax was not caused by a lack of demand or poor product ideas.

It was caused by an infrastructure that was never designed or upgraded to support what the product required.

This case shows that in digital financial services, infrastructure is not a background detail — it is the foundation.

Without modern, reliable USSD session management, even the best ideas cannot survive.